Associate Payroll Tax Analyst

Hazelwood, Missouri; Renton, Washington Job ID 00000421167 Category Finance Post Date Apr. 18, 2024Job Description

At Boeing, we innovate and collaborate to make the world a better place. From the seabed to outer space, you can contribute to work that matters with a company where diversity, equity and inclusion are shared values. We’re committed to fostering an environment for every teammate that’s welcoming, respectful and inclusive, with great opportunity for professional growth. Find your future with us.

Join The Boeing Company's prestigious Global Finance Service team as an Associate Payroll Tax Analyst. With locations in Hazelwood, MO, or Renton, WA, you'll have the chance to work alongside industry leaders and make a real impact.

As an Associate Payroll Tax Analyst, you'll play a crucial role in ensuring compliance with tax regulations at the local, state, and federal levels. You'll handle tasks such as retrieving, compiling, and reconciling data for audits, as well as managing Federal, state, local, and property tax reporting. Additionally, you'll stay current with the latest changes in tax laws and regulations, keeping our company ahead of the curve.

Your expertise will be invaluable in assisting with internal and external audits related to payroll taxes. Collaborating closely with HR, finance, and other departments, you'll ensure seamless alignment on payroll tax matters. Furthermore, you'll have the opportunity to provide guidance and training to stakeholders on payroll tax compliance requirements and procedures.

Seize this thrilling opportunity to soar to new heights with The Boeing Company.

Our Ideal Candidate:

Ability to work independently and collaboratively in a fast-paced environment

Strong knowledge of accounting systems and processes

Proficient in conducting evidence-based analysis and making strategic decisions to resolve tax-related issues

In-depth understanding of payroll tax regulations and laws

Ability to interpret and explain employment tax laws to stakeholders

Position Responsibilities:

Process and reconcile payroll tax payments accurately and in a timely manner

Prepare and file Federal, state, and local payroll tax returns on a quarterly and annual basis

Respond to inquiries from tax agencies and resolve any payroll tax-related issues or discrepancies

Maintain up-to-date knowledge of payroll tax laws and regulations, including changes in tax rates and filing requirements

Collaborate with internal stakeholders, such as the payroll team and finance department, to ensure accurate reporting and compliance with payroll tax obligations

Investigate and resolve payroll tax-related inquiries or discrepancies

This position is hybrid. This means that the selected candidate will be required to perform some work onsite at one of the listed location options. This is at the hiring team’s discretion and could potentially change in the future.

This position must meet export control compliance requirements. Tomeet export control compliance requirements, a “U.S. Person” as defined by 22 C.F.R. §120.15 is required. “U.S. Person” includes U.S. Citizen, lawful permanent resident, refugee, or asylee.

Basic Qualifications (Required Skills/Experience):

Bachelor's degree or higher in accounting, finance, business administration, or a related field.

1+ years of experiences in payroll tax

Experience creating and analyzing data and metrics through the use of HR systems (HRMS, PeopleSoft, Taleo, etc) and Microsoft Office tools (Excel, PowerPoint, etc.)

Preferred Qualifications (Desired Skills/Experience):

Certification such as a CPA, CIA, CMA, CPP and/or a higher education certificate in accounting

Excellent analytical and problem-solving skills.

Experience managing multiple projects simultaneously, prioritizing tasks, and meeting deadlines in a fast-paced environment

Typical education and experience:

Education/experience typically acquired through advanced education (e.g. Bachelor) and typically 3 or more years' related work experience or an equivalent combination of education and experience (e.g. Master+1 years' related work experience, 7 years' related work experience, etc.).

Relocation:

Relocation assistance is not a negotiable benefit for this position. Candidates must live in the immediate area or relocate at their own expense.

Drug Free Workplace:

Boeing is a Drug Free Workplace where post offer applicants and employees are subject to testing for marijuana, cocaine, opioids, amphetamines, PCP, and alcohol when criteria is met as outlined in our policies.

Shift:

This position is for 1st shift.

At Boeing, we strive to deliver a Total Rewards package that will attract, engage and retain the top talent. Elements of the Total Rewards package include competitive base pay and variable compensation opportunities.

The Boeing Company also provides eligible employees with an opportunity to enroll in a variety of benefit programs, generally including health insurance, flexible spending accounts, health savings accounts, retirement savings plans, life and disability insurance programs, and a number of programs that provide for both paid and unpaid time away from work.

The specific programs and options available to any given employee may vary depending on eligibility factors such as geographic location, date of hire, and the applicability of collective bargaining agreements.

Pay is based upon candidate experience and qualifications, as well as market and business considerations.

Summary pay range: $68,000– $88,000

Applications for this position will be accepted through May 05, 2024.

Export Control Requirements: U.S. Government Export Control Status: This position must meet export control compliance requirements. To meet export control compliance requirements, a “U.S. Person” as defined by 22 C.F.R. §120.15 is required. “U.S. Person” includes U.S. Citizen, lawful permanent resident, refugee, or asylee.

Export Control Details: US based job, US Person required

Equal Opportunity Employer:

Boeing is an Equal Opportunity Employer. Employment decisions are made without regard to race, color, religion, national origin, gender, sexual orientation, gender identity, age, physical or mental disability, genetic factors, military/veteran status or other characteristics protected by law.

Your Benefits

No matter where you are in life, our benefits help prepare you for the present and the future.

- Generous company match to your 401(k).

- Industry-leading tuition assistance program pays your institution directly.

- Fertility, adoption, and surrogacy benefits.

- Up to $10,000 gift match when you support your favorite nonprofit organizations.

These programs are subject to eligibility requirements and other conditions, which may differ for employees of certain subsidiaries or business units, or union-represented employees depending on bargaining agreement terms. If this information conflicts with the program documents, the latter shall control. This material is informational only.

-

Search for Events in Your Area

Search for Events in Your AreaOur hiring events are a great way to learn about our innovations and culture.

-

Our Environment

Our EnvironmentWe're committed to environmental stewardship — an important pillar of our broader sustainability strategy to help make the world better for future generations.

-

Career Areas

Career AreasJoin our team of innovators and dreamers, engineers and designers, cybersecurity experts and technologists. This is where you'll help build tomorrow today.

-

Community Engagement

Community EngagementSee how everyone here is an involved and engaged member of our communities.

-

Innovation is in our DNA

Innovation is in our DNASee how we innovate and operate to make the world better.

-

Boeing Career SkillBridge Program

Boeing Career SkillBridge ProgramApply for opportunities in engineering, product support, IT, manufacturing and other areas.

-

Shaping Tomorrow's Innovations

Shaping Tomorrow's InnovationsOklahoma City is where you’ll shape tomorrow’s innovations.

-

Denise and Kay, Materials Engineers

Denise and Kay, Materials EngineersMother and daughter duo Denise and Kay push aerospace innovation forward every day.

-

Tresha, Chief Engineer

Tresha, Chief EngineerFascinated by kit airplanes as a child, Tresha is now chief engineer for the world’s most efficient twin-engine jet.

-

Kariza, Composite Research Engineer

Kariza, Composite Research EngineerWith a curiosity inspired by school projects, Kariza now helps develop sustainable aerospace technology.

-

Boeing's Employee Referral Program

Boeing's Employee Referral ProgramLearn how Boeing employees can earn a bonus by referring external hires.

-

Boeing Pre-Employment Training Program

Boeing Pre-Employment Training ProgramThe Boeing Pre-Employment Training Program (BPET) allows students from pre-certified academic manufacturing programs to skip the interview process when applying for specific manufacturing jobs at Boeing.

-

Military Spouse Career Accelerator Pilot Program

Military Spouse Career Accelerator Pilot ProgramOur 12-week paid fellowship connects individuals with training, networking opportunities and hands-on experience.

-

-

UK Apprenticeship

UK ApprenticeshipOur three-year apprenticeships offer diverse experiences and prepare you to work on our aircraft.

-

Return Flight Program

Return Flight ProgramBoeing’s Return Flight Program provides people with a pathway to return to their careers after an extended break.

-

‘Understand the challenges to see the opportunities’

‘Understand the challenges to see the opportunities’Christina Upah believes problem-solving starts with a great team.

-

‘Take the time to connect with others’

‘Take the time to connect with others’Ida Eggeblad uses interpersonal skills to connect teams across countries

-

‘I was encouraged to get out of my comfort zone’

‘I was encouraged to get out of my comfort zone’How a conversation at a career fair led business operations leader Jennifer Hayden on an unexpected career path.

-

‘We’re solving the world’s hardest problems’

‘We’re solving the world’s hardest problems’From intern to leader, east to west and in between, Laura shares how business and technology merge

-

'Stay curious'

'Stay curious'Rodney Kruse shifts his perspective each day by asking, “What have I learned?”

-

‘Dyslexia doesn’t limit me; it’s an asset’

‘Dyslexia doesn’t limit me; it’s an asset’A teammate’s skill for seeing the bigger picture helps her lead transformation at work and in her personal life.

-

A Boeing family champions autism awareness

A Boeing family champions autism awareness'At Boeing, I've found a supportive environment where my attention to detail and focus are valued.'

-

An engineer's career takes flight

An engineer's career takes flight'My team and I are using advanced tools and technologies to help chart Boeing’s future.'

-

'I leaped into the unknown'

'I leaped into the unknown'Suellen achieved her dream to become a Boeing engineer. Now she’s mentoring our future leaders.

-

Allies Spreading Awareness

Allies Spreading AwarenessElizabeth and Maggie share their stories on celebrating the perspectives and accomplishments from LGBTQIA+ employees and allies across Boeing.

-

Mother and Son Use Boeing Tuition Assistance To Learn — Together

Mother and Son Use Boeing Tuition Assistance To Learn — TogetherMeet Melanie Brisbane, recent graduate and human resources professional. See how Melanie reached her dreams with help from our tuition assistance program.

-

-

Boeing Technical Apprenticeship Program

Boeing Technical Apprenticeship ProgramEarn as you learn technical skills and receive credentials that can set you up for success.

-

'Speaking up can save lives'

'Speaking up can save lives'Read how Dr. Catherine Sinclair, a software engineer with Boeing Defence Australia, increases awareness of domestic abuse and supports gender equity.

-

Giving Back to the Country She Loves

Giving Back to the Country She LovesRomina Cutescu, a systems engineer, works on programs that are critical to homeland security.

-

Two Ways To Stay Connected

Two Ways To Stay ConnectedJoin our Global Talent Network and sign up for Job Alerts to learn about additional opportunities.

-

‘I knew this was the place for me’

‘I knew this was the place for me’Meet Anika Bell, an Army veteran and university recruiter who’s passionate about building diverse connections for an innovative future.

-

'Take your seat at the table'

'Take your seat at the table'Aurelina Prada started at Boeing as an aircraft mechanic. Today, she's advocating for gender equity as a supply chain senior manager.

-

Meet Emily, Flight Test Engineer

Meet Emily, Flight Test EngineerSince interning, Emily completed rotations in four business units and worked on the cargo air vehicle program. Today, she is a flight test conductor for the T-7A program.

-

Respect From Day One

Respect From Day OneBoeing engineers Gus and Casady share how Out in Science, Technology, Engineering and Mathematics (oSTEM) helps them feel seen and heard.

-

Thurgood Marshall College Fund

Thurgood Marshall College FundBoeing's partnership with Thurgood Marshall College Fund is an initiative supporting HBCUs through campus recruitment, career immersion, scholarships, and more.

-

Continuous Improvement: Meet Enrica, Industrial Engineer

Continuous Improvement: Meet Enrica, Industrial EngineerFind out how Enrica is advancing her career at prestigious universities around the world with tuition assistance from Boeing.

-

Leading by Example: Meet Tony, Vice President of Army Systems

Leading by Example: Meet Tony, Vice President of Army SystemsAnthony 'Tony' Crutchfield, Boeing vice president and retired lieutenant general, shares decades of leadership experience with students and early career professionals from underrepresented communities.

-

Angelie Vincent, Product Development Engineer, Recounts Her Journey With Autism

Angelie Vincent, Product Development Engineer, Recounts Her Journey With AutismAngelie has been with Boeing for 12 years and was diagnosed with autism in April 2019. Through her story, she inspires others to overcome adversity.

-

Meet Nathan: Phantom Works Operations Analyst

Meet Nathan: Phantom Works Operations AnalystNathan helps our defence customers make decisions using the power of modelling and simulation.

-

A Mother-Daughter Duo Bond Over Invention

A Mother-Daughter Duo Bond Over InventionMeet Kay and Denise, inventors of an adhesive removal tool and an inspiration to other innovators across our company.

-

Accessibility Accommodations

Accessibility AccommodationsIf you need a reasonable accommodation for any part of the employment process, please contact us.

-

Meet Shanying Zeng

Meet Shanying ZengShanying Zeng is Boeing’s technical expert on the International Aerospace Environmental Group, which is helping Boeing find environmentally progressive alternatives for hazardous chemicals and material used in commercial and military aircraft.

-

How Jacob Grew His Career From Mechanic to Manager

How Jacob Grew His Career From Mechanic to ManagerRead how our Leading in Manufacturing training helped Jacob become a people-focused leader.

-

It’s No Ordinary 9 to 5 For Manufacturing Engineer Lee

It’s No Ordinary 9 to 5 For Manufacturing Engineer LeeMeet Lee, a manufacturing engineer in Boeing’s Melbourne factory who has worked on commercial and defense aircraft, including the first Australian-made autonomous military aircraft, known as the MQ28A Ghost Bat.

-

Get your degree on us

Get your degree on usOur tuition assistance program pays your institution directly so you don’t have to pay out of pocket. Learn about our generous funding for courses, certificates, undergraduate and graduate degrees.

-

'What are your qualifications?'

'What are your qualifications?'Meet Danielle and Ankita, two teammates who are breaking biases with the help of allies.

-

Cyber Security Guard: Meet Anna Guthrie, Product Security Engineer

Cyber Security Guard: Meet Anna Guthrie, Product Security EngineerProduct security engineer Anna Guthrie builds resilient technologies to protect against cyberattacks. In this interview, she offers a glimpse into a day in her life with our growing cybersecurity team.

-

No barriers to entry

No barriers to entryThree teammates champion a new approach to helping overcome the “mid-career crisis” and increasing diversity at all levels.

-

Unlock the secret to conquering fear

Unlock the secret to conquering fearEngineering manager Aslihan Karlidag uses Boeing’s digital learning opportunities to keep her fears at bay

-

‘There’s no better place to explore new roles and opportunities than Boeing’

‘There’s no better place to explore new roles and opportunities than Boeing’Senior software manager Chad Peterson knows that growth happens outside the comfort zone

-

‘When you feel like the professor, it’s time to be the student again’

‘When you feel like the professor, it’s time to be the student again’Vice president Tresha Lacaux landed her dream internship at Boeing. Today, she’s landed her dream role

-

-

'I feel a part of the Boeing family'

'I feel a part of the Boeing family'Discover how our Neurodiversity at Work program helped Thomas launch his software engineering career.

-

Noah Stockwell, Production Systems Engineering Intern

Noah Stockwell, Production Systems Engineering InternMeet Noah, a Production Systems Engineering Intern at Boeing who's enhancing airplane assembly processes and exploring aerospace's future.

-

K’Lynn King, Chemical Technologies, Materials and Processes Intern

K’Lynn King, Chemical Technologies, Materials and Processes InternLearn how this Chemical Technologies Intern advanced the aircraft painting process.

-

‘I’m inspired by the belief that we can always improve’

‘I’m inspired by the belief that we can always improve’Meet Dr. Rongsheng “Ken” Li, a Principal Technical Fellow who has been awarded for his work in aerospace guidance, navigation and control systems.

-

J’Nea Greer, Human Resources Intern

J’Nea Greer, Human Resources InternLearn how Boeing helped shape the career path of this HR Intern and Spelman College economics grad.

-

Kanchan Vinayak Bhale, Systems Engineer Intern

Kanchan Vinayak Bhale, Systems Engineer InternLearn how this systems engineering intern benefited from spending the early years of her career at a leading aerospace company.

-

Meet Suba, a Space Launch Systems Leader who Broke Barriers

Meet Suba, a Space Launch Systems Leader who Broke BarriersDiscover how Suba Iyer turned her fascination with how things work into an engineering career.

-

From Interns to Innovators: Systems Engineers Blaze Paths to Success

From Interns to Innovators: Systems Engineers Blaze Paths to SuccessMeet two systems engineers who are contributing to the next era of spaceflight.

-

Meet Sanh, 777X Design Engineer

Meet Sanh, 777X Design EngineerRead how Sanh Ha, an engineer who is deaf, applied innovative thinking to safely overcome obstacles during a test flight.

-

Benefits

BenefitsOur Total Rewards program includes best-in-class benefits designed to meet your needs at every stage in life.

-

Working Here

Working HereWe're a company of inquisitive, talented people. Find out what's important to us and what inspires us to do amazing things together.

-

Inside Boeing

Inside BoeingSee what it means to be part of #TeamBoeing. Explore stories and learn how our people grow their careers while shaping the future of aerospace.

-

Our Locations

Our LocationsOur global presence includes employees and operations in more than 65 countries. Explore some of our locations.

-

Frequently Asked Questions

Frequently Asked QuestionsSee some of the most commonly asked questions about starting a career with Boeing.

-

Accelerated Leadership Program

Accelerated Leadership ProgramDesigned for college sophomores majoring in engineering, this program prepares our next generation of leaders to take charge.

-

We Go Further Together

We Go Further TogetherWe're committed to advancing equity, diversity and inclusion, and we make progress toward our 2025 aspirations.

-

Search for Events in Your Area

Search for Events in Your AreaOur hiring events are a great way to learn about our innovations and culture.

-

Military and Veterans

Military and VeteransYou can join the more than 18,000 veterans who chose Boeing to be their next mission.

-

Entry-Level Careers

Entry-Level CareersWork on projects with a scope few companies can match in an entry-level role — where many of our senior leaders started their careers.

-

Internships

InternshipsGain hands-on experience and work alongside a team of industry leaders as you help build the future.

-

-

-

-

Boeing in South Korea

Boeing in South KoreaWe’re proud of our 75-year partnership with South Korea. Join us and help revolutionize aerospace development from the heart of Seoul.

-

Boeing in India

Boeing in IndiaThe most exciting advances in aerospace are being developed today in India. Join us and build a career at the center of our industry’s future.

-

Boeing in the UK

Boeing in the UKAcross 30 key locations in the UK, we employ more than 3,000 highly skilled teammates. And, after 80 years of success, we keep growing.

-

Boeing in Washington, D.C.

Boeing in Washington, D.C.Whether you're a software engineer, systems engineer, or cyber analyst, help us solve tough challenges and contribute to the security of the nation.

-

Boeing in Missouri

Boeing in MissouriJoin us and contribute to next-generation aircraft, training, and defense products and capabilities.

-

Boeing in Poland

Boeing in PolandWe develop technologies that will shape the future of flight and we need your curiosity and unique perspective to help keep us innovating.

-

Boeing in Oklahoma

Boeing in OklahomaLearn how we continue to create opportunities for bright minds and see what makes this a great place to build a career.

-

Boeing in Alabama

Boeing in AlabamaAs the largest aerospace company in the state, we play a vital role in the U.S. space and defense programs.

-

Boeing in California

Boeing in CaliforniaAs we transform aerospace, your skills will take center stage. Join us and help connect, protect and explore our world and beyond.

-

Boeing in Brazil

Boeing in BrazilFor more than 90 years, we’ve partnered with Brazil and today you can join a team filled with creative minds who are building what’s next.

-

Boeing in Texas

Boeing in TexasExplore what makes Boeing in Texas a great place to work.

-

Boeing in Japan

Boeing in JapanFor more than 50 years, we’ve worked closely with Japan to help create the future of aerospace and bring new expertise to our future-focused products.

-

Boeing in Arizona

Boeing in ArizonaKnown for producing the Apache and Little Bird aircraft, we’re also home to centers of excellence in software, composites, wiring and fabrication.

-

Boeing in South Carolina

Boeing in South CarolinaAcross our manufacturing plants, research and technology center, engineering center and propulsion sites, we’re developing new advances in flight.

-

Boeing in Washington State

Boeing in Washington StateAt the center of aviation since 1916, many of our most innovative products are designed and built here.

-

Kether Berrios, B-52 Engine Performance and Operability Intern

Kether Berrios, B-52 Engine Performance and Operability InternFrom the University of Puerto Rico to working on Boeing commercial airplanes — learn how this intern got hands-on experience with cutting-edge automation techniques.

-

'We are finding ways to inspire more people around us'

'We are finding ways to inspire more people around us'Meet Nic, a leader in the UK who is advancing equity and entrepreneurial innovation to solve aerospace challenges.

-

Aniketh Aangiras, Electrical Subsystems Design Intern

Aniketh Aangiras, Electrical Subsystems Design InternDiscover how Boeing reignited a passion for Electrical Engineering for one intern by bridging theory and real-world application.

-

Ariah Warner, Financial Analyst Intern

Ariah Warner, Financial Analyst InternSee how Boeing fuels ambition, inspiring one intern to broader her career goals beyond her major.

-

From Making Soap to Making a Difference: Meet Oscar Johnson

From Making Soap to Making a Difference: Meet Oscar JohnsonA lifelong interest in chemistry sparked this engineer to desegregate lunch counters in 1960 and unveil cutting-edge technology in Boeing laboratories 50 years later.

-

'There's room for all types of leaders'

'There's room for all types of leaders'Teresa is a product engineer and inventor with multiple patents. Learn how she's helping to close gaps for Asian women in STEM.

-

Meet Bo, E-7A Wedgetail Systems Engineer

Meet Bo, E-7A Wedgetail Systems EngineerBo designs and develops software and hardware that supports the Wedgetail's missions. Watch the video to learn how his work has an immediate impact.

-

Recruitment Fraud Alert

Recruitment Fraud AlertBe aware of fraudulent job offers purporting to be from The Boeing Company and/or its affiliates. Learn what to look for.

-

‘I want to be an example for women in aerospace’

‘I want to be an example for women in aerospace’Read how Chantel, a manager in workforce and engineering, is breaking ground in representation and aerospace history.

-

Meet Marvi Matos Rodriguez, Design Practices Engineer

Meet Marvi Matos Rodriguez, Design Practices EngineerMarvi applies her love of invention to challenging problems, and works towards her personal mission: to serve as many people as possible.

-

Meet Nelson Akwari

Meet Nelson AkwariRead about Nelson's journey from the soccer field to becoming an accomplished engineer and leader at Boeing South Carolina.

-

Meet Sarah, Manufacturing Engineer

Meet Sarah, Manufacturing EngineerSarah designs and manufactures flight control components for Boeing commercial aircraft in Australia.

-

Meet Shanth, Mechanical Engineer

Meet Shanth, Mechanical EngineerShanth shares his journey from intern — working on NASA's Space Launch System and the CH-47 Chinook— to deputy chief of staff for our chief engineer.

-

Keeping the World Moving

Keeping the World MovingMeet Susana, a supplier quality specialist in Mexico who's using problem-solving skills to drive operational excellence.

-

Easing the Transition of U.S. Service Members

Easing the Transition of U.S. Service MembersLearn how our partnership with SkillBridge is supporting veteran teammates in discovering their next mission.

-

-

Rachel Hutson, Material Accounting Intern

Rachel Hutson, Material Accounting InternMeet Rachel, a Material Accounting Intern who was a part of the team tracking and managing parts for Boeing Defense & Space.

-

Raveena Karia, Design Engineer Intern

Raveena Karia, Design Engineer InternMeet Raveena, a Design Engineering Intern at Boeing. With an Aerospace Engineering background from the University of Nottingham, she shares insights from working on the Structures team in Frimley.

-

Sardor Nazarov, Supply Chain Analyst

Sardor Nazarov, Supply Chain AnalystMeet Sardor, a Supply Chain Analyst intern at Boeing, who shares insights into his virtual internship experience, the impact of Boeing's mission, and his commitment to building a successful future.

-

Vidhi Patel, Structural Design Engineer Intern

Vidhi Patel, Structural Design Engineer InternWhat is Vidhi's advice for aspiring engineering interns? Apply, adapt, and be a part of Boeing's innovation journey.

-

Meet Jacqueline Lam, Global Sustainability Leader

Meet Jacqueline Lam, Global Sustainability LeaderAn inclusive approach is helping Jacqueline drive sustainable aviation in Southeast Asia.

-

Career Advice from the KC-46 Chief Mechanic

Career Advice from the KC-46 Chief MechanicFrom challenges to bright spots, Boeing’s KC-46 chief mechanic shares tips and lessons learned to help future leaders.

-

Catalina Reinhart-Diaz | Systems Engineer Intern

Catalina Reinhart-Diaz | Systems Engineer InternThere are so many things to explore within Boeing, and the company makes it easy to do so.

-

Jessica Grillo, IT&DA Application Programmer/Developer Intern

Jessica Grillo, IT&DA Application Programmer/Developer InternFight your imposter syndrome and apply! When you are here, your number one priority is to learn, and stay hungry. You are never done learning. This will be the best experience of your life because you will see how bright your future is and how far Boeing will take you.

-

Isabelle Troya, Ground Systems Engineer Intern

Isabelle Troya, Ground Systems Engineer InternMeet Isabelle, a systems engineer intern at Boeing. Discover her journey from University of South Florida to impactful work in defense programming.

-

Clocking In: How 7 Hours a Week Changed Jesus’ Life

Clocking In: How 7 Hours a Week Changed Jesus’ LifeMeet Jesus Sanchez, a power machine operator in Auburn, Wash. See how Jesus used our tuition assistance program to obtain an associate degree in business.

-

Ian Hong, Engineering Intern

Ian Hong, Engineering InternMeet Ian, an engineering intern at Boeing Global Services and Stanford University student who is building his skills and embracing challenges.

-

Pushing Boundaries: Meet Our TMCF Scholars

Pushing Boundaries: Meet Our TMCF ScholarsBoeing's partnership with Thurgood Marshall College Fund helped these two students land their dream jobs.

-

‘There's a future for everyone here’: Meet Zan Truluck

‘There's a future for everyone here’: Meet Zan TruluckAs a global equity, diversity and inclusion leader, Zan works to ensure everyone feels they belong.

-

Three Keys to Mission Success

Three Keys to Mission SuccessAlex Campos, a Boeing Missile Defense contracts administrator and U.S. Navy reservist, shares his advice for staying on mission.

-

Building a Family On Their Terms

Building a Family On Their TermsRead how Kristin Innes and her partner Bonnie are growing their family with help from Boeing's fertility benefits.

-

'If You Live Long Enough, You Will Experience Some Disability'

'If You Live Long Enough, You Will Experience Some Disability'Nick Perry shares why understanding, identifying with and talking about disabilities helps reduce stigmas.

-

Taking the Leap and Finding Success

Taking the Leap and Finding SuccessMeet Kim, Greta and Miwa: Three women who took chances and developed their careers on their own terms.

-

Not Your Ordinary 9 to 5

Not Your Ordinary 9 to 5Meet Jimmy, an Air Force veteran and aviation safety coordinator that helps teams operating the F/A-18F Super Hornet and EA-18G Growler get home safely.

-

The Power of an Invitation

The Power of an InvitationDarcy and Susan discuss their experiences as transgender women and the effects inclusion — and exclusion — have on their time at work.

-

‘If you do right, right will follow you’

‘If you do right, right will follow you’Engineers Debra and Stacia discuss the importance of community connection and making an impact through even small actions.

-

Meet KJ

Meet KJFrom the Rosebud Reservation in South Dakota to leading attack helicopter programs in Mesa, AZ., Kathleen “KJ” Jolivette inspires STEM interest among Native American students.

-

'It's hard to describe the thrill of it'

'It's hard to describe the thrill of it'Meet Ty'Quish, a mechanical engineer who has helped design and build the next-generation assault helicopter.

-

Meet Jinnah Hosein, Vice President and Chief Software Engineer

Meet Jinnah Hosein, Vice President and Chief Software EngineerOur software engineering challenges are immense. But the possibilities are even greater. Learn how our team is harnessing the power of future-forward computing.

-

An Engineer's Creative Edge Helps Customers Chart Their Course

An Engineer's Creative Edge Helps Customers Chart Their CourseA a modeling and simulation engineer for Boeing Ground-based Midcourse Defense, or GMD, Kyle mostly deals in a world that’s conceptual, using a modeling system to simulate and predict how a customer request will perform in a real-world scenario.

-

It's a learner's paradise: Meet Rakesh Nanda

It's a learner's paradise: Meet Rakesh NandaDiscover how Rakesh and the design engineering team at the 787 Interiors Responsibility Center in India innovate and grow.

-

The Best Call That I've Made

The Best Call That I've MadeFaced with caring for two sick family members, Sandra Lankford leaned on Boeing's caregiver benefits for support. Watch Sandra's story.

-

Automation is the Future

Automation is the FutureRead how Sarah Wauahdooah, a manufacturing research and development engineer, applies her robotics expertise on the V-22 Osprey program.

-

Meet Satyaki, Helicopter Engineer

Meet Satyaki, Helicopter EngineerSatyaki helps to keep the Australian Army’s CH-47 Chinook helicopters flying around the clock.

-

Meet Shruthi, Design Engineer

Meet Shruthi, Design EngineerShruthi discusses innovating with her design build team, and taking her next career step as a manufacturing engineer at Boeing in India.

-

‘I gained a family of leaders’

‘I gained a family of leaders’Stephanie Yount, engineer and recent Leadership Next graduate, discovers she’s most comfortable when she’s completely uncomfortable.

-

'You can have 20 careers at Boeing'

'You can have 20 careers at Boeing'Meet Boeing finance leader Terrence Chance, and discover the breadth of the experience that's shaped his career.

-

UK Equal Opportunity Statement

UK Equal Opportunity StatementWe are an equal opportunity employer.

-

Non US EOE Statement

Non US EOE StatementWe are an equal opportunity employer.

-

5 Tips for Acing Your Virtual Interview

5 Tips for Acing Your Virtual InterviewDalena Nguyen, a Talent Acquisition Advisor, shares her top tips for making a great first impression when interviewing by phone or online.

-

'Never stop learning'

'Never stop learning'Discover how our digital learning resources helped Boeing India teammate Antara upskill.

-

Meet Abbey Carlson: Former Intern Turned Space and Launch Engineer

Meet Abbey Carlson: Former Intern Turned Space and Launch EngineerAbbey Carlson, a former Boeing intern, shares her two major milestones: graduating from college and accepting her first job with Boeing.

-

Meet Francis: Inventor Strives to Make Space Safer

Meet Francis: Inventor Strives to Make Space SaferA Senior Composite Engineer at Boeing’s Satellite Development Center, Francis, says each patent represents a step toward achieving her childhood goal to make space safer.

-

Glen Elliot: 'Everyone told me not to do it'

Glen Elliot: 'Everyone told me not to do it'Glen shares a personal story about a family member who was involved in an auto accident. For years after Glen avoided flying due to safety regulations that prohibit passengers from sitting in their own wheelchairs on airplanes.

-

‘Engineering reaches every industry; it’s part of everyday life’

‘Engineering reaches every industry; it’s part of everyday life’Meet Hana McKee, an engineer whose curiosity inspires her to innovate the next generation of rotorcraft.

-

Jae’s Early Fascination With Flight Led to a Role at Boeing

Jae’s Early Fascination With Flight Led to a Role at BoeingMeet Jae, a systems engineer on the world’s leading airborne early warning and control aircraft, Boeing’s E-7A Wedgetail.

-

A Veteran's Secret Weapon

A Veteran's Secret WeaponWhat Marcie Purser, program management specialist, brings to the table is highly valued at Boeing: lasting connection.

-

Meet Marcela

Meet MarcelaElectrical engineer Marcela Angulo works on next-generation defense technology and inspires Hispanic students to get involved in STEM.

-

Aliyah Terry | Engineering Intern

Aliyah Terry | Engineering InternI was first introduced to Boeing during a Thurgood Marshall College Fund (TMCF) immersion experience in the summer of my freshman year in college.

-

Alex Nelson | Estimating & Pricing Intern

Alex Nelson | Estimating & Pricing InternI love Boeing’s commitment to connect the world. As someone who has family all around the globe, it's this commitment that enables me to visit my loved ones no matter how far away they may be.

-

On a Mission to Lead

On a Mission to LeadLearn how one of our development programs – a partnership with MIT – is helping an engineer get on a path to executive leadership.

-

'The possibilities are endless'

'The possibilities are endless'From space to defense, senior software and project engineer, Kimberly Sledge, inspires the next generation of Black women in STEM.

-

‘Here you can build your career the way you want’

‘Here you can build your career the way you want’Chandler is pursuing her passions thanks in part to our development programs and tuition assistance.

-

Meet OB, Starliner Spacecraft Technician

Meet OB, Starliner Spacecraft TechnicianFrom making repairs on aircraft to building spacecraft, Oborsouis "OB" Saint-Louis has had his hands in a little bit of everything.

-

Meet Suzanne, Chief Engineer

Meet Suzanne, Chief EngineerSuzanne Brown is an avid sailor and chief engineer for the Patriot Advanced Capability-3 Missile seeker program.

-

Meet Jennifer, Boeing's First Female Chief Mechanic

Meet Jennifer, Boeing's First Female Chief MechanicSee how Jennifer helps engineers understand assembly principles that lead them to design better airplanes.

-

Aim High: Meet Kristine, Space Launch Systems Engineer

Aim High: Meet Kristine, Space Launch Systems EngineerKristine Ramos, design engineer, goes above and beyond to advocate for human spaceflight.

-

‘I’m a lifelong learner’

‘I’m a lifelong learner’Meet Nixon, an engineer who uses our tuition assistance to stay on the cutting edge of emerging technology.

-

Great Acoustics: 'Passion for music helps compose a career'

Great Acoustics: 'Passion for music helps compose a career'Meet Indica Bennett, an engineer whose hobby inspired a dream job.

-

‘I don’t just translate — I bridge gaps’

‘I don’t just translate — I bridge gaps’Meet Dama, an engineer and manager who strengthens our company by being a cultural and technical integrator.

-

‘I’ve challenged myself to grow’

‘I’ve challenged myself to grow’Read how Kaomi Hashimoto has grown her career across continents, while supporting our next generation of leaders.

-

'Helping people reach their potential inspires me'

'Helping people reach their potential inspires me'Meet Wilton, a Quality manager for the Space Launch System program who helps create a culture where everyone can speak up.

-

‘I encourage others to take this opportunity!’

‘I encourage others to take this opportunity!’From aircraft assembler to avionics engineer, Vadym Vasylyshyn grew his career with our tuition assistance program.

-

Meet Dylan, 737 MAX In-Tank Mechanic

Meet Dylan, 737 MAX In-Tank MechanicLearn how 737 MAX mechanics squeeze through a tight opening to perform final inspection and cleaning before testing.

-

David E. Vargas | Spacecraft Systems Engineer Intern

David E. Vargas | Spacecraft Systems Engineer InternEvery Boeing team, including my own, is working diligently to preserve and feed the flames of human progress through the management and development of complex aerospace systems that we design, develop and produce every day.

-

DJ Serrano | Human Resources Intern

DJ Serrano | Human Resources InternThis internship provided me with a vast network of talented individuals and leaders with different educational and developmental experiences that also align with my own career goals.

-

Trisha Khandelwal | Vibration, Shock and Acoustic Analysis Intern

Trisha Khandelwal | Vibration, Shock and Acoustic Analysis InternThis internship provided me with invaluable insights and skills that will undoubtedly guide my educational and career path.

-

'Lean into discomfort': Career Advice From a Chief Engineer

'Lean into discomfort': Career Advice From a Chief EngineerPete Kunz, Phantom Works chief engineer, describes opportunities that have shaped his career and shares tips for success.

-

'It may not be easy, but it will pay off': Meet Rayni Sivley

'It may not be easy, but it will pay off': Meet Rayni SivleyAs project manager for Ground-based Midcourse Defense, Rayni isn't bothered by roadblocks. Read her advice for career growth.

-

Love at First Flight

Love at First FlightAn operations manager and an analyst for the V-22 tiltrotor thrive on teamwork in the factory and at home.

-

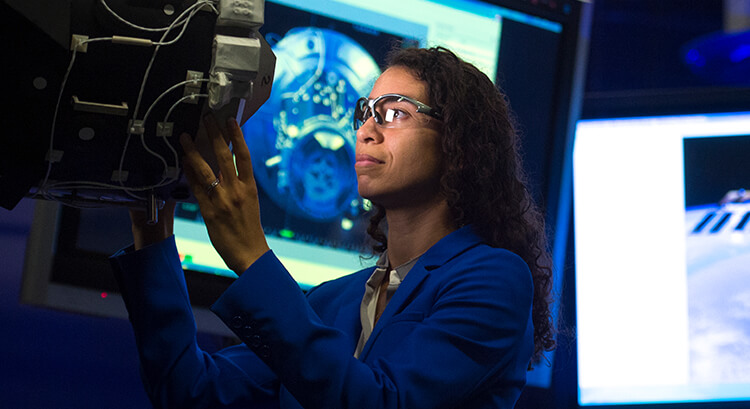

Cybersecurity Careers at Boeing

Cybersecurity Careers at BoeingBoeing is more than airplanes. More than satellites. More than cutting-edge cyber solutions. We work together with advanced technology on projects for the defense and intelligence communities. Join our Cybersecurity team.

-

Electronic and Electrical Engineering Careers at Boeing

Electronic and Electrical Engineering Careers at BoeingElectrical engineers work closely with our customers to develop electronic and electrical systems for Boeing aircraft, and world-class autonomous robotic systems for space, terrestrial, and underwater hardware. Learn more about the team.

-

Finance Careers at Boeing

Finance Careers at BoeingOur finance professionals play a key role in guiding critical business decisions and cutting-edge solutions for the world’s leading aerospace company. Learn more.

-

Flight Engineering Careers at Boeing

Flight Engineering Careers at BoeingFlight engineers are essential to the development, safety and success of our products and solutions. Learn more about the team.

-

Information Technology Internships at Boeing

Information Technology Internships at BoeingLearn how you can get access to cutting-edge technology and grow your skills through our Information Technology & Data Analytics Intern Program.

-

Electrical Engineering Internships

Electrical Engineering InternshipsA chance to start your career designing and building our next generation of products.

-

Human Resources Careers at Boeing

Human Resources Careers at BoeingBoeing HR professionals support our employees as they manage their career path, develop their teams and chart the course for career development. Learn how you can join the team.

-

Industrial Engineering Careers at Boeing

Industrial Engineering Careers at BoeingDiscover how you can make a difference at Boeing as an industrial engineer. Become part of a team that drives innovation across diverse technologies worldwide.

-

Test and Evaluation Engineering Careers at Boeing

Test and Evaluation Engineering Careers at BoeingAs a Test and Evaluation Engineer at Boeing, you'll ensure that our next-generation commercial and defense products and systems meet the highest standards. Join us as we continue to push the boundaries of aerospace.

-

Software Engineering Careers at Boeing

Software Engineering Careers at BoeingAs a software engineer at Boeing your code will power products that defy gravity and fly faster than the speed of sound.

-

Supply Chain Management Careers at Boeing

Supply Chain Management Careers at BoeingWith a career in supplier management at Boeing, you can help solve business challenges that are redefining an entire industry.

-

Systems Engineering Careers at Boeing

Systems Engineering Careers at BoeingAs a Systems Engineer at Boeing, you can help drive the overall design of innovative and high-quality products and solutions.

-

Business Operations Internships

Business Operations InternshipsIn our Business Intern Program, you can be part of a team that is helping shape the future of aerospace.

-

-

Human Resources Internships

Human Resources InternshipsIn our Business Intern Program, you can be part of a team that is helping shape the future of aerospace.

-

Supply Chain Internships

Supply Chain InternshipsIn our Supply Chain Intern Program, you can be part of a team that is helping shape the future of aerospace.

-

Data Science and Analytics Careers at Boeing

Data Science and Analytics Careers at BoeingData doesn’t work in silos — it needs to breathe and interact with other information in order to tell the whole story, not just parts of it. At Boeing, we’re working across our enterprise to let data and information drive our collective decision-making. Join our Data Science and Analytics team today.

-

Information Technology Careers at Boeing

Information Technology Careers at BoeingAs part of our Information Technology and Data Analytics team, you’ll support one of the largest corporate IT portfolios anywhere. Join us and help build the future.

-

Materials, Process and Physics Engineering Careers at Boeing

Materials, Process and Physics Engineering Careers at BoeingCome build the future with Boeing and develop the next generation of aircraft, space and underwater vehicles and revolutionary approaches to manufacturing.

-

Mechanical and Structural Engineering Careers at Boeing

Mechanical and Structural Engineering Careers at BoeingMechanical and structural engineers at Boeing develop and apply innovative technologies that shape the future. Learn more.

-

Product Security Engineering Careers at Boeing

Product Security Engineering Careers at BoeingDiscover how you can make a difference at Boeing as a product security engineer. Become part of a team that drives innovation across diverse technologies worldwide.

-

Production Engineering Careers at Boeing

Production Engineering Careers at BoeingAt Boeing, our production engineers use their skills to build the future of advanced manufacturing. Learn more.

-

Manufacturing Careers

Manufacturing CareersEvery day around the globe, Boeing manufacturing employees build the future of aerospace. Join our team. Your future is waiting.

-

Specialty Engineering Internships

Specialty Engineering InternshipsA chance to start your career designing and building our next generation of products.

-

Software Engineering Internships

Software Engineering InternshipsA chance to start your career designing and building our next generation of products.

-

Systems Engineering Internships

Systems Engineering InternshipsA chance to start your career designing and building our next generation of products.

-

Test & Evaluation Engineering Internships

Test & Evaluation Engineering InternshipsA chance to start your career designing and building our next generation of products.

-

-

-

Global Real Estate and Facilities Internships

Global Real Estate and Facilities InternshipsA chance to start your career designing and building our next generation of products.

-

Finance Internships

Finance InternshipsIn our Finance Intern Program, you can be part of a team that is helping shape the future of aerospace.

-

Flight Engineering Internships

Flight Engineering InternshipsA chance to start your career designing and building our next generation of products.

-

Industrial Engineering Internships

Industrial Engineering InternshipsA chance to start your career designing and building our next generation of products.

-

Materials, Process & Physics Engineering Internships

Materials, Process & Physics Engineering InternshipsA chance to start your career designing and building our next generation of products.

-

Mechanical & Structural Internships

Mechanical & Structural InternshipsA chance to start your career designing and building our next generation of products.

-

Facilities and Asset Management Engineering Internships

Facilities and Asset Management Engineering InternshipsA chance to start your career designing and building our next generation of products.

-

Boeing in Ukraine

Boeing in UkraineOur teams in Ukraine provide engineering expertise, consultation services, research and technical assistance for our platforms and aircraft that fly worldwide.

-

‘It takes all of us to build this plane’

‘It takes all of us to build this plane’Nadiya’s Cherokee Nation heritage guides a unifying approach with her team.

-

“When you ask veterans for help, you get it.”

“When you ask veterans for help, you get it.”Joshua, a veteran of the U.S. Air Force, once helped repair our aircraft. Now he flies in them.

-

The sky’s the limit

The sky’s the limitMeet Ronak, a Boeing India teammate who’s used our tuition assistance to grow his career, studying online and abroad.

-

Boeing in Australia

Boeing in AustraliaJoin a team of more than 4,300 people providing leading-edge aviation services for our defense and commercial customers.

-

-

Excellence with Caring' is Key: Meet Dr. Nathan Brooks

Excellence with Caring' is Key: Meet Dr. Nathan BrooksBoeing's first Black Senior Technical Fellow grew from humble beginnings to executive leader and mentor.

-

AI creator changes how autonomous systems work

AI creator changes how autonomous systems work‘It’s about technology and innovation that will transform aerospace as we know it.’

-

-

-

Explore careers with Boeing Phantom Works

Explore careers with Boeing Phantom WorksDiscover a career with Phantom Works, Boeing’s advanced research and development division, and shape the future of aerospace. Apply today for engineering, cybersecurity, data intelligence jobs and more.

Jobs for You:

No recently viewed jobs.

View all of our available opportunitiesNo saved jobs.

View all of our available opportunitiesConnect with us

Join our Talent Community

Get updates about Boeing job opportunities, events and career information.

Sign up for our Talent CommunityVeteran Talent Community

Transition to a career in engineering, product support, IT, manufacturing or other areas.

Sign up for our Veteran Talent Community